Which is must and mandatory Setup.... Otherwise no Localization Taxes will be available to be applied on the Transactions…

Create Tax Manager Responsibility for intended Operating Unit where Localization Taxed are to be applied….

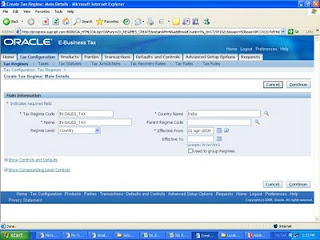

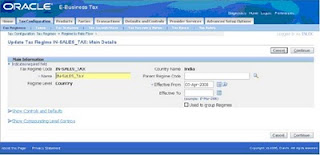

Step 1: Define Regime

Navigation: Tax Manager – Parties – Party Tax Profiles – Tax Configuration Tab

Following regime should be defined with exact values as shown below:

Following data should be entered while defining the tax regime:

Tax Regime Code IN-SALES_TAX

Name IN-SALES_TAX

Regime Level: Country

Country Name: India

Effective Date: current date

Suggession-- (keeping in mind the legacy data upload idealy we should give previous Year From Date)

Press continue.

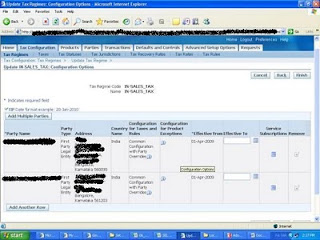

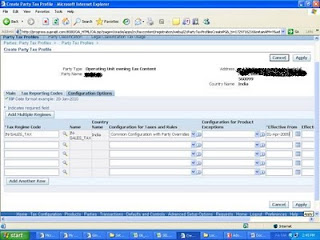

Set "Configuration Options" as follows:

You need to set value for "Configuration for Taxes and Rules" as "Common

Configuration with Party Overrides"

Add all the Legal entities here as shown below

Select your Legal Entities from LOV and give respective addresses

Note-Legal Entity Name and Address fields in above image I have kept in black delebrately due to Security of Information.

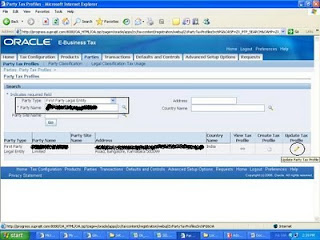

Step 2: Party tax profile

Then go to partiesà Party tax profile query for the legal Entity as shown below and verify the above entered data is updated in the Update tax profile screenà Configuration Option

Note- Enter yor Legal Entity and Address and Click Update Tax Profile

Click Apply

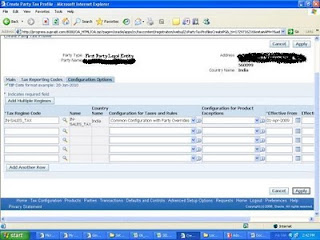

Step 3:

Now Again select the Party type as “Operating Unit owing Tax Content” and Party Name as the operating unit and then press go

Then Create tax profile

The following Flag should not be checked.

Go to the configuration option tab Enter the information below

Save and apply

Repeat the step3 for all the operating units if in case there are more than 1 OUs under 1 Legal Entity.

Step 4 : Create Tax

Navigation: Tax Manager – Parties – Party Tax Profiles – Tax Configuration Tab

Create a Tax with following values:

Tax Regime Code IN-SALES_TAX

Configuration Owner Global Configuration Owner and Operating Unit *

Tax Source Create a new tax

Tax LOCALIZATION

Tax Name LOCALIZATION

This setup needs to be carried out for once at the Legal Entity level and also for EACH

Operating Unit in which you wish to use Oracle Financials for India.

Please enter values for "Tax Recovery Controls" as follows:

Allow Tax Recovery check box should be checked and "Primary Recovery Type" should be PREC1.

Step 5: Create Tax Status

Navigation: Tax Manager – Parties – Party Tax Profiles – Tax Configuration Tab

Create Tax Status with following values:

Tax Status Code STANDARD

Name LOCALIZATION

Effective From current date

Suggession-- (keeping in mind the legacy data upload idealy we should give previous Year From Date)

This setup needs to be carried out for once at the Legal Entity level and also for EACH

Operating Unit in which you wish to use Oracle Financials for India.

Review your work in the Regime to Rate flow

Click on highlighted Icon or--

Step 6: Create Tax Rate

Navigation: Tax Manager – Parties – Party Tax Profiles – Tax Configuration Tab

Create Tax Rate with following values:

Tax Rate Code LOCRATE

Rate Type Percentage

Percentage Rate 0

Effective From current date

Suggession-- (keeping in mind the legacy data upload idealy we should give previous Year From Date)

Step 7: Update Tax Configuration Options

Navigation: Tax Manager – Parties – Party Tax Profiles – Tax Configuration Tab

Review Configuration Owner Tax Options, ensure they are as following:

Navigation: Tax Manager – Parties – Party Tax Profiles – Defaults and Controls Tab

Note:-This setup has to be carried out for all operating units and not for legal entity

Hi please send me GST documents

ReplyDeleteHi Mahesswara, you can follow metalink note id:2176820.2 for GST documentation/ setups for all modules. You can download user guide for P2P and O2C.

ReplyDeleteHi Anu Sharma,I didnt get access for meta link,If you dont mine can you please share me GST documents nmreddyapps@gmail.com

ReplyDelete