E Business Tax Setup for India Localization

It is Mandatory to define Regime Rate Flow for Getting the India Localized Tax Defaulted in all the Transactions.

1. Define Party Tax Profiles

2,Define tax Configurations

3.Regime to Rate Flow

4.Tax Applicability to Applications

Tax Configuration has Below Functional Setups

Tax regime

Taxes

Tax status Code

Tax jurisdiction

Tax recovery rate

Tax rate

Tax Rules

Responsibility Creation:

Tax Manager is the Responsibilty With Menu as “E-Business Tax Homepage”

Below Setup Screen Shots Done in 8010 Instance For Operating unit CHN OU2 in BG 1223.

Creating party Profiles

Navigation:

E Business tax → Parties → party Tax Profiles

Select Party Type as “Operating Unit Owning Tax Content”

Party Name → Operating Unit for Which the Tax to be Setup –CHN OU2

Go to create tax Profile:

For India Localization Do Not Check use Subscription of the Legal Entity

Click Apply ; Message Will Appear on Home Screen as Below.

Define Tax Configuration:

Navigation

E Business Tax → Tax Configuration

Tax Regime creation

Navigation

E Business Tax → Tax Configuration → Tax regimes

Tax regime Code--Ram Tax Regime

Name--Ram Tax Register

Regime Level—Country

Country Name-- India

Tax Currency—INR

Click Continue → Page Will Navigate to

Add OU details

Tax Creation

Navigation → E Business tax → Tax Configuration → Taxes

Click create

Add Informations

Click Apply and Confirmation Message Will Appear

Tax Status

Navigation

E Business tax → Tax Configuration → Tax Statuses

Click create

set as default

Click Apply

Confirmation Message Will Appear as Above

Create Tax Jurisdiction Code

Navigation

E Business tax → Tax Configuration → Tax jurisdiction

Click Apply → Confirmation Message Will Appear

Creating Tax rates

Navigation

E Business Tax → Tax Configuration → Tax Rates

Click create

Create Tax Rate as “LOCRATE” and set the Rate as Zero

Go to rate details and set the LOCRATE as Default rate

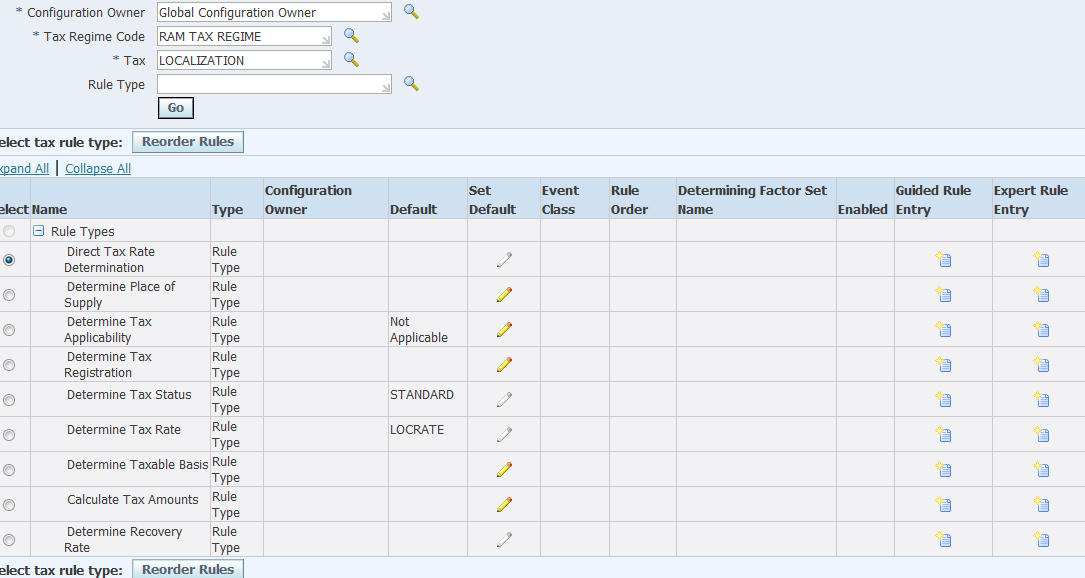

Creating Tax rules

Navigation

E Business Tax → Tax Configuration → Tax Rules

Search With Config Owner , Tax regime Code and Tax

1. In Determine Place Of Supply Set Below Rule

Select the Rule “Ship to, use bill to if ship to is not found”

2. in determine Tax Registration Set the same Rule

3. In Determine Taxable Basis Set Default Rule as Standard_TB

4.In Rule Type Calculate tax Amounts Set Default Rule as Standard_TC

5. In Determine Tax Applicability Set Default Rule as Applicable

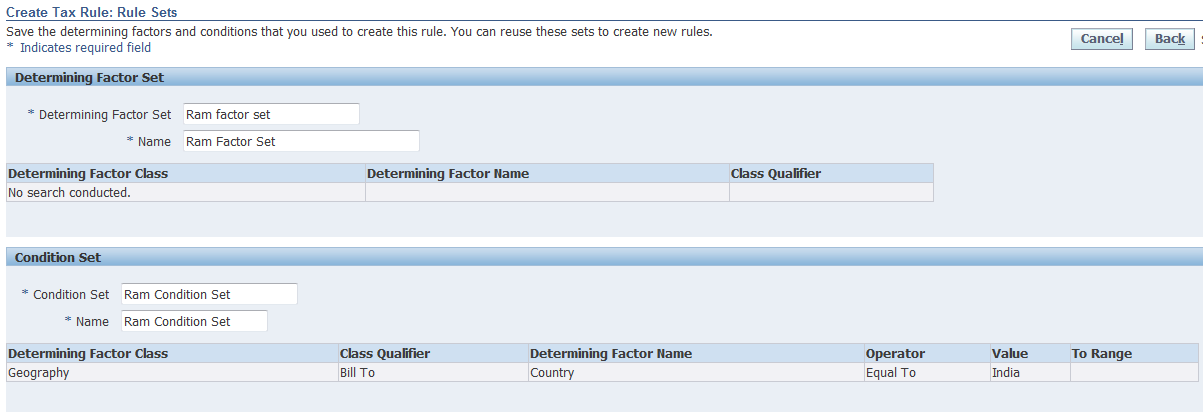

6. In Determine Tax Rate –- select Guide Rule Entry

Fill general Information

Click next for Applying Conditions

Click Next For Applying the results

Select the Tax rate and Click Next for applying Rule Order

Click Next for Applying the Rule Sets

Click Finish → Confirmation Message Along With Tax rule Will Appear

Creating Tax Recovery rate

Navigation

E Business Tax → Tax Configuration → Tax recovery rate

Click Create

Set as Default Rate Check Box has to be Enabled

Then Click Apply → Confirmation Message Will Appear

Go to Taxes For Updating the Default Recovery Rate and Enabling it for transaction

Navigation

E Business Tax → Tax Configuration → Taxes

Click update

Regime to rate Flow

Navigation

E Business Tax → Tax Configuration → Tax regimes

Query the Tax regime created

Click on Regime to Rate Flow Icon on Right Last

Drill Down the result

Tax Applicability to Applications

Navigation

E Business tax → Defaults and Controls → Application tax Options → create

No comments:

Post a Comment