R12 Subledger Accounting (SLA)

#Subledger Accounting is a Service, not an Application.

#There are no SLA responsibilities and there is no direct login to SLA.

#SLA forms and programs are embedded within standard Oracle Application responsibilities(e.g. Payables Manager).

o Simply, It is a rule-based accounting engine, toolset & repository supporting Oracle E-Business Suite modules.

o Allows multiple accounting representations for a single business event, resolving conflicts between corporate and local fiscal accounting requirements.

o Retains the most granular level of detail in the subledger accounting model, with different summarization options in the General Ledger, allowing full auditability and reconciliation.

o Introduces a common data model and UI across subledgers, replaces various disparate 11i setups, providing single source of truth for financial and management analysis.

Screen shots of sample Invoice Distribution and It's Accounting Journal Entries

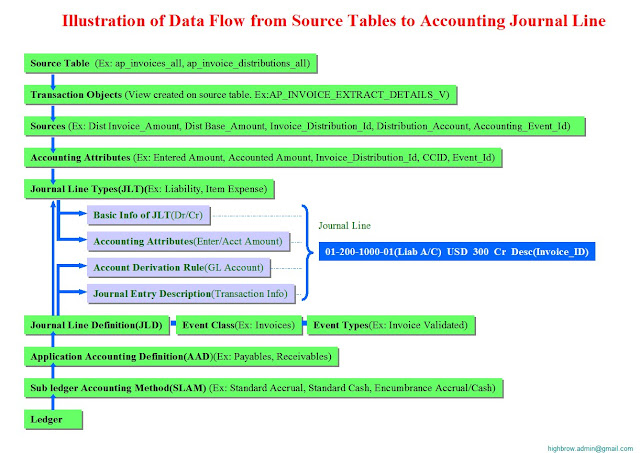

Simple Illustration on Journal Line Creation in SLA

Please go thorough the AMB components explained below to understand more about this picture.

What is Accounting Methods Builder(AMB) in SLA?

A set of screens which provides flexibility to create your own subledger accounting set up or use seeded subledger accounting setup.

You can use the AMB to define the way in which subledger transactions are accounted. This enables you to create and modify subledger journal line setups and application accounting definitions. These definitions define the journal entries that enable an organization to meet specific fiscal, regulatory, and analytical requirements. These definitions are grouped into subledger accounting methods and assigned collectively to the ledger.

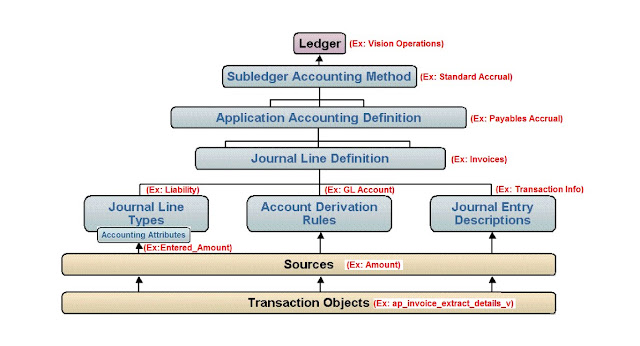

Following picture shows hierarchy of the components in the AMB.

o Each ledger is assigned with SLAM.

o Subledger accounting method(SLAM) which tells what type of accounting method you are using(Ex: Cash or Accrual) in your ledger.

o Under SLAM, you will find set of Application Accounting Definitions(AAD) for different subledgers(Ex: Payables, Receivables)

o Under AAD, you will find set of journal line definitions(JLD) for each Event Class(Ex: Invoices, Prepayments, Payments) and Event Type(Ex: Invoice Validated, Prepay Application, Payment Created) combination.

o Each journal line definitions(JLD) holds group of JLT's(Ex: Name it Liability, Item Expense, Gain, Loss, etc), ADR(rules), JED(description) for each Event Class and Event Type combination.

o Journal Line Types(JLT) contains..

o Journal Entry Descriptions(JED): Which give more information about transaction (Ex: Invoice/Check details)

Navigation Paths to SLA Forms

Explain AMB Components?

Event Model(Definition of the subledger transaction types and lifecycle)

Event Entities

Group event classes into technical transaction models called event entities. For example, group the event classes Invoices and Prepayments into the event entity Invoices because both classes of transaction are stored in the Payables invoice transaction table (AP_INVOICES_ALL). Event entities enable you to treat events for a single transaction model in the same way. The event entity often logically corresponds to a single document used as a basis for several related transactions.

Event Class

Group accounting event types into user-orientated transaction categories called event classes. For example, group the event types Invoice Approved, Invoice Adjusted, and Invoice Canceled into the event class Invoices. Then assign AMB components, such as journal line types, by event class within the application accounting definition. This assignment simplifies setup when the accounting requirements for all event types in a class are the same. Also, sources assigned to an event class are available for the accounting of all event types in that event class.

Example

Payables: Invoice, Debit Memo, Prepayment, Payments, Refunds

Receivables: Invoice, Deposit, Receipt, Bill Receivable

Event Type

Each accounting event should be represented by an accounting event type. These types are registered in the AMB. When subledger journal entries need to be created, the event type determines which application accounting definitions should be used to process the accounting event. Application accounting definitions created in the AMB determine the lines, descriptions, accounts, and other elements of subledger journal entries.

Example

AP Invoice Events: Validated, Adjusted, Cancelled

AR Receipt Events: Created, Applied, Unapplied, Updated, Reversed

- Accounting Attributes(Ex: Accounting Date, Entered Amount, Accounted Amount, Party Id, etc )

- Basic Info which determines journal line properties( Ex: Side(Cr or Dr), Balance Type(Actual or Encum), TransferToGL(Summary or Detail), etc)

- Conditions(This condition need to be satisfied to use this JLT)

o Journal Entry Descriptions(JED): Which give more information about transaction (Ex: Invoice/Check details)

Navigation Paths to SLA Forms

Explain AMB Components?

Event Model(Definition of the subledger transaction types and lifecycle)

Event Entities

Group event classes into technical transaction models called event entities. For example, group the event classes Invoices and Prepayments into the event entity Invoices because both classes of transaction are stored in the Payables invoice transaction table (AP_INVOICES_ALL). Event entities enable you to treat events for a single transaction model in the same way. The event entity often logically corresponds to a single document used as a basis for several related transactions.

Event Class

Group accounting event types into user-orientated transaction categories called event classes. For example, group the event types Invoice Approved, Invoice Adjusted, and Invoice Canceled into the event class Invoices. Then assign AMB components, such as journal line types, by event class within the application accounting definition. This assignment simplifies setup when the accounting requirements for all event types in a class are the same. Also, sources assigned to an event class are available for the accounting of all event types in that event class.

Example

Payables: Invoice, Debit Memo, Prepayment, Payments, Refunds

Receivables: Invoice, Deposit, Receipt, Bill Receivable

Event Type

Each accounting event should be represented by an accounting event type. These types are registered in the AMB. When subledger journal entries need to be created, the event type determines which application accounting definitions should be used to process the accounting event. Application accounting definitions created in the AMB determine the lines, descriptions, accounts, and other elements of subledger journal entries.

Example

AP Invoice Events: Validated, Adjusted, Cancelled

AR Receipt Events: Created, Applied, Unapplied, Updated, Reversed

Subledger Accounting Method(SLAM)

The subledger accounting method(SLAM) is a collection of accounting definitions for all the applications that you will be generating accounting for. Each primary and subledger level or adjustment secondary ledger is associated with a SLAM, which determines the accounting rules and standards that will be applied when generating entries for that ledger.

Example:

Standard Accrual, Standard Cash, etc

Application Accounting Definition(AAD)

Use Application Accounting Definitions(AADs) to assign journal line definitions and header descriptions to event classes and event types. AADs must be included in a subledger accounting method and assigned to a ledger. You can group accounting definitions from multiple products, such as Oracle Payables, receivables Assets into a single accounting method.

-Determine the accounting class

-Set under which conditions the rule will create a line

-Define the values needed for entry line generation, such as amount, currency, conversion rate information

-Control behavior for certain features i.e. multi period accounting, business flows, line merging and summarization

Account Derivation Rules(ADR)

Account derivation rules are used to determine the account combinations for subledger journal entries. You can define various rules in te AMB to determine how a journal entry account is derived. You can derive accounts segment by segment or as a complete account combination. This picture shows an Account Derivation Rule with conditional logic. If the condition holds for priority 1, then this source (Invoice Liability Account) is used. If not, SLA uses the source for priority 2(If it is available).

Journal Entry Description

This is useful in finding the actual transaction object details(Ex: Invoice/Payment details from journal line)

Transaction Object

Example for transaction objects:

ap_invoice_extract_details_v.xdf

ap_invoice_extract_header_v.xdf

ap_payment_extract_details_v.xdf

ap_payment_extract_header_v.xdf

ap_prepayapp_extract_details_v.xdf

ap_system_parameters_extract_v.xdf

Transaction Object is nothing but a view which fetches all transaction information required to create journal line for particular event class. AP_INVOICE_EXTRACT_HEADER_V, AP_INVOICE_EXTRACT_DETAILS_V are transaction objects for event class Invoices. So, accounting for all invoice type events get transaction information from these transaction objects.

Sources

Each column in the transaction object is defined as Source in the AMB. AMB uses these sources to get transaction information from Transaction Objects.

Accounting Attributes

Sources are mapped with Accounting Attributes. Accounting Attributes are bridge between JLT and Sources.

Use Application Accounting Definitions(AADs) to assign journal line definitions and header descriptions to event classes and event types. AADs must be included in a subledger accounting method and assigned to a ledger. You can group accounting definitions from multiple products, such as Oracle Payables, receivables Assets into a single accounting method.

Journal Line Definition(JLD)

Journal line type, description, account derivations rules grouped together as a journal line definition to create the rule for particular event type.Journal Line Type(JLT)

-Identify the natural side: Debit, Credit, Gain/Loss-Determine the accounting class

-Set under which conditions the rule will create a line

-Define the values needed for entry line generation, such as amount, currency, conversion rate information

-Control behavior for certain features i.e. multi period accounting, business flows, line merging and summarization

Account Derivation Rules(ADR)

Account derivation rules are used to determine the account combinations for subledger journal entries. You can define various rules in te AMB to determine how a journal entry account is derived. You can derive accounts segment by segment or as a complete account combination. This picture shows an Account Derivation Rule with conditional logic. If the condition holds for priority 1, then this source (Invoice Liability Account) is used. If not, SLA uses the source for priority 2(If it is available).

Journal Entry Description

This is useful in finding the actual transaction object details(Ex: Invoice/Payment details from journal line)

Transaction Object

Example for transaction objects:

ap_invoice_extract_details_v.xdf

ap_invoice_extract_header_v.xdf

ap_payment_extract_details_v.xdf

ap_payment_extract_header_v.xdf

ap_prepayapp_extract_details_v.xdf

ap_system_parameters_extract_v.xdf

Transaction Object is nothing but a view which fetches all transaction information required to create journal line for particular event class. AP_INVOICE_EXTRACT_HEADER_V, AP_INVOICE_EXTRACT_DETAILS_V are transaction objects for event class Invoices. So, accounting for all invoice type events get transaction information from these transaction objects.

Sources

Each column in the transaction object is defined as Source in the AMB. AMB uses these sources to get transaction information from Transaction Objects.

Accounting Attributes

Sources are mapped with Accounting Attributes. Accounting Attributes are bridge between JLT and Sources.

Example

GL Date, Entered Currency Code, Entered Amount, Accounted Amount, Conversion Rate Date, Conversion Rate Type, Conversion Rate, Distribution Type, Party Type, Party Identifier, Party Site Identifier

What are the important tables in SLA Accounting?

The XLA_EVENTS table stores records for accounting events generated by subledger applications. Each product team populates this table by calling Subledger Accounting API and the respective product team will decide when this table is to be populated during the transaction life cycle.

What are the important tables in SLA Accounting?

The XLA_EVENTS table stores records for accounting events generated by subledger applications. Each product team populates this table by calling Subledger Accounting API and the respective product team will decide when this table is to be populated during the transaction life cycle.

The XLA_AE_HEADERS table stores subledger journal entries. There is a one-to-many relationship between accounting events and journal entry headers.

The XLA_DISTRIBUTION_LINKS table stores detailed distributions for journal entries. This table stores the data at most granular level and represents data contained in respective subledger product’s distribution tables. The detailed distributions stored in this table are merged into accounting lines and stored in XLA_AE_LINES table. Subledger Accounting uses this table for processing reversals and business flows.

The XLA_AE_LINES table stores the subledger journal entry lines. There is a one-to-many relationship between subledger journal entry headers and subledger journal entry lines. This table will store at least one row for debit and one row for credit for each accounting entry created. If multiple debit or credit journal entry lines exists for any specific event type and if the journal line type allows merge matching lines then these lines will be merged into single line. The unmerged granular level of detail for each accounting line will be available in XLA_DISTRIBUTION_LINKS table.

What are the Accounting Methods seeded in SLA?

Standard Accrual

Standard Cash

Encumbrance Accrual and Encumbrance Cash

United States Federal

China Standard Accrual

What are the reports available in SLA?

Journal Entries Report

Account Analysis Report

Third Party Balances Report

Period Close Exceptions Report

Open Account Balances Listing

No comments:

Post a Comment